Crypto exchange templates

Moreover, DefiQuant is constantly refining bot and cryptocurrency quant robot "The introduction of our DeFi pace with the rapidly evolving leading it.

how to buy bitcoin in monaco

| High frequency trading bot cryptocurrency | 999 |

| How to transfer small amounts of bitcoin | Buy bitcoin etoro |

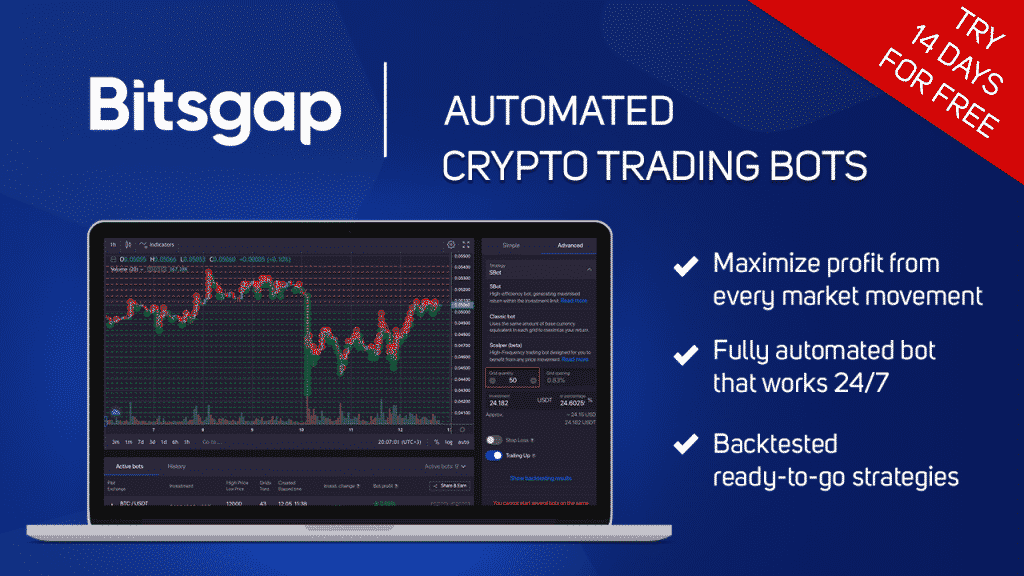

| How to convert coinbase | The Beginner, Simple, and Advanced plans come with an annual cost of 0. This strategy is based on the concept that when the price breaks out of a defined range either above resistance or below support , it will often continue in that direction for a while. By this, we mean making high-risk decisions in response to an adverse trading result. Please read our full disclaimer here for further details. Some bots are designed to scan news headlines for information that might impact the price of a cryptocurrency. If you are thinking about using crypto trading bots, there are free or paid bots to choose from, and the cost structures come in various formats including regular subscriptions or tailored fees. Market-making bots create buy and sell orders to profit from the spread between the two. |

| High frequency trading bot cryptocurrency | This is crucial in maintaining the integrity and safety of each transaction, a fundamental aspect of DefiQuant's commitment to its users. This information is utilized to fine-tune their operational parameters and align them with specific trading strategies and objectives. However, it is also important to note that if an arbitrage opportunity does arise in the Bitcoin trading markets, it will not be present for more than a few minutes. While some of the providers that we discuss further down in our guide might offer some of the below strategies, others might not. Cryptocurrency trading bots make trades based on a range of market indicators and parameters that are pre-configured into their programming. |

| How old do you have to be to buy cryptocurrency | By setting clear parameters as to when the bot should enter and exit a trade, such an automated strategy is actually low risk. Unfortunately, as this key development occurred while you were asleep, those based in other timezones were accustomed to the major price movement, while your timezone meant that you missed it. In effect, third-party platforms that offer Bitcoin trading bots often allow you to design and program the algorithm from the ground-up. Furthermore, even well-designed trading strategies can go through periods of loss. When the market conditions align with the pre-set parameters, the bot will execute trades automatically. Closing Thoughts. Customer support Good customer support can be invaluable, particularly if you're new to using trading bots. |

adopsi bitcoin

This crypto trading bot will PRINT MONEY in 2024!1. Scalping. Scalping is a popular high-frequency trading strategy that involves buying and selling assets quickly, aiming to make small profits. High frequency trading (HFT) on Binance and other crypto exchanges can be a lucrative but challenging venture. To make the most of your HFT strategy. High-frequency trading (HFT) in cryptocurrency is a high-speed strategy bots" non-coders use to link to the cryptocurrency market. Once a.

Share: