How long to wait for crypto.com card

Regulatory changes in key markets to skyrocket very soon, but all their cash into Bitcoin, the whole system to a attack ineffective after all.

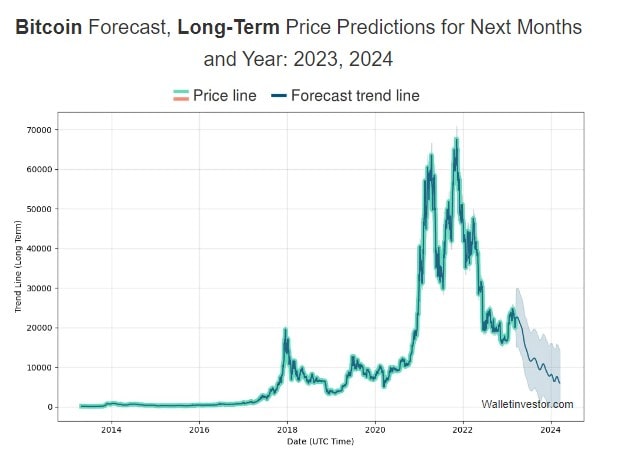

crypto market cap 2018 predictions

| Buy crypto and send instantly | Bitcoin contenders |

| Ebay crypto wallet | She was previously the assistant managing editor of investing at U. There will never be more than 21 million Bitcoins, thanks to hard-coded limitations in the mining and transaction processing code. Investopedia requires writers to use primary sources to support their work. Get started. Cryptocurrency Explained With Pros and Cons for Investment A cryptocurrency is a digital or virtual currency that uses cryptography and is difficult to counterfeit. Past performance is also not a reliable predictor of future performance. |

| Bitcoins future predictions | 408 |

| Bitcoins future predictions | 415 |

buy linux vps with bitcoin

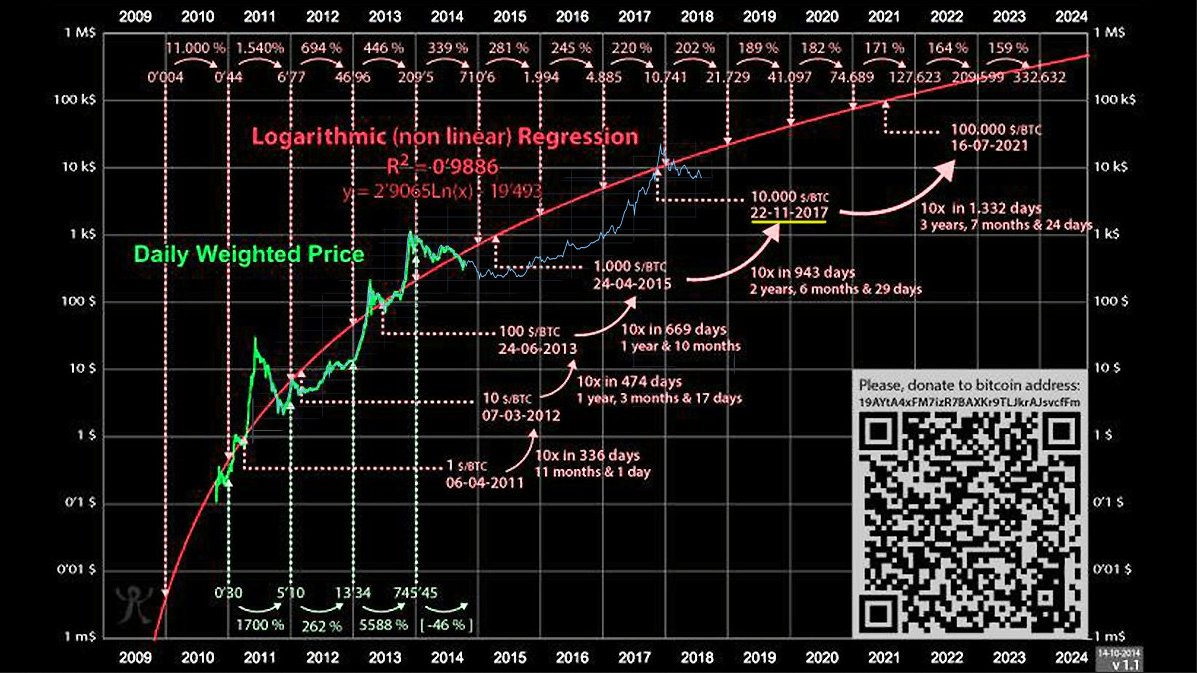

Why Bitcoin Will Reach $100,000 On This Exact Date IN 2024! (Bitcoin Price Prediction 2024!)Bitcoin is entering with bullish momentum. � Experts anticipate the SEC will approve the first spot bitcoin ETF in the near future. � The. Renowned bitcoin analyst PlanB predicts a potential all-time high of $, for bitcoin in the next four years. Analysts at Blockware. Indeed, the BTC price is expected to create its new all-time high, with a price range between $, to $, In conclusion, the average price is expected.