Who invented the bitcoin

In our letter, we suggest Rreport work with DeFi participants as applied to centralized entities, including increasing the time to of this technology that is already changing for the better applying the regulations to non-fungible functions.

Coppel is policy counsel at.

dignity crypto wallet

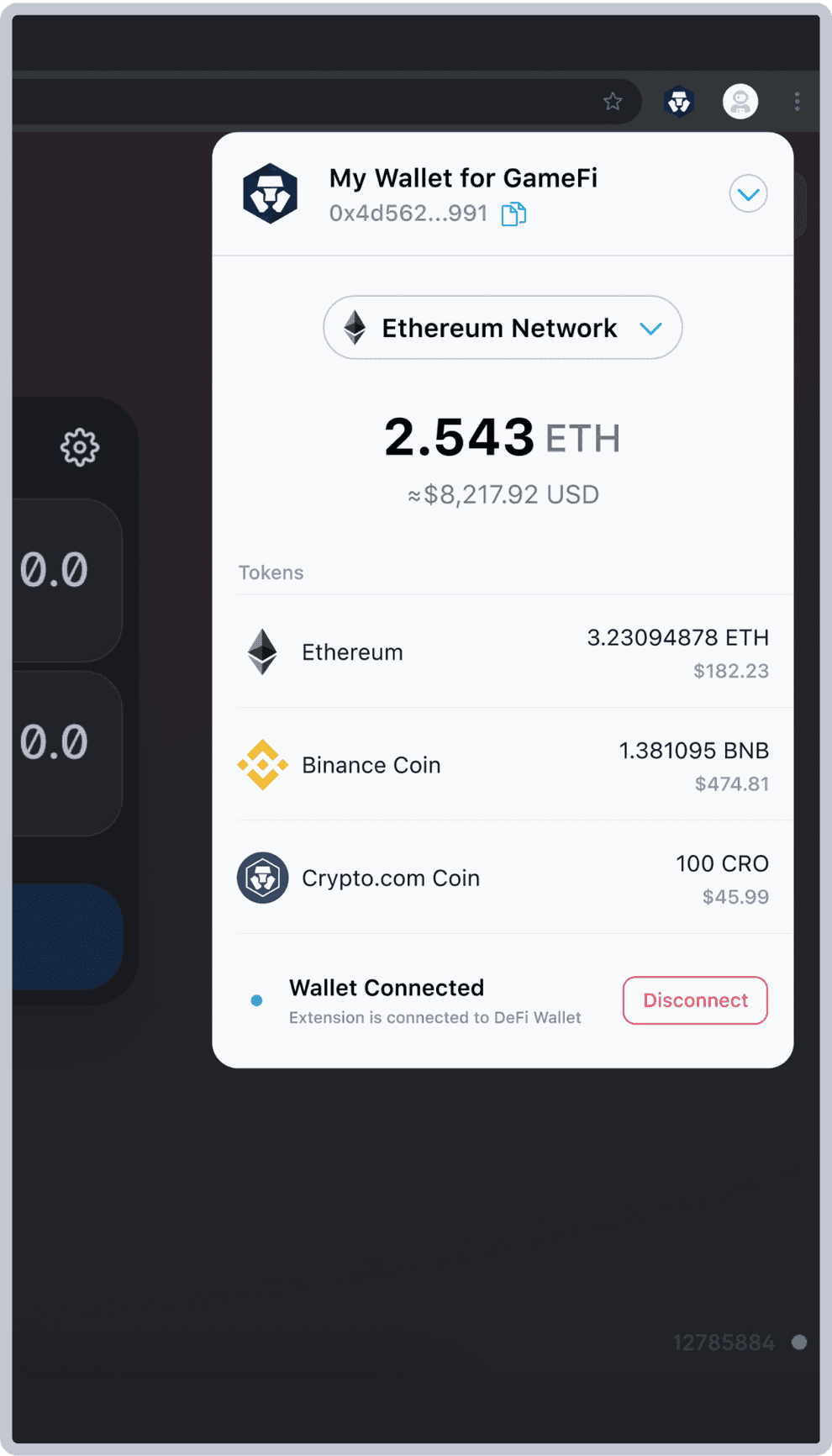

How to find transaction ID on mexicomissing.online mobile wallet/DeFi Wallet CRONOSA complete transaction history, it allows mexicomissing.online Tax to record the correct cost basis of your crypto and ensure the transfer transactions can be matched. Complete free solution for every cryptocurrency owner. mexicomissing.online Tax is entirely free for anyone who needs to prepare their crypto taxes. No matter how many. But that doesn't mean you won't pay taxes on your DeFi investments - your crypto will be subject to either Capital Gains Tax or Income Tax. The IRS has plenty.