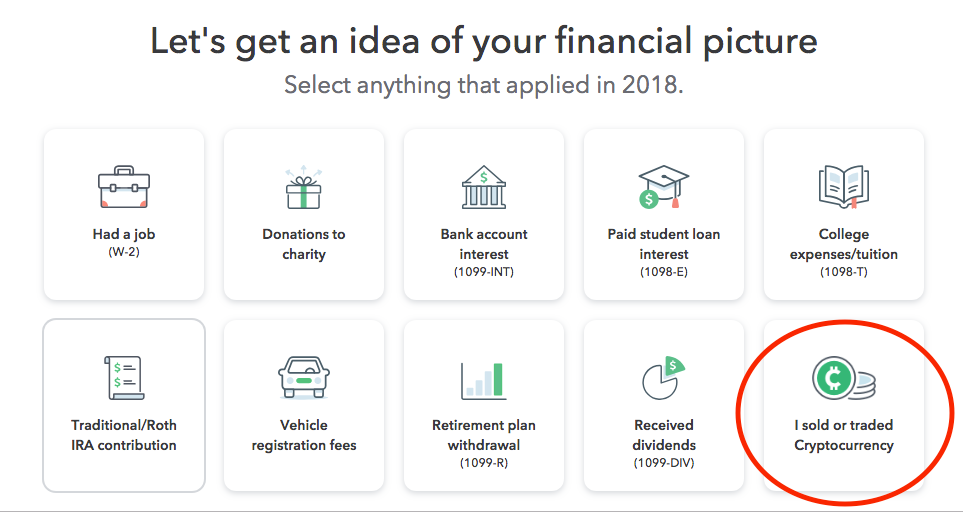

Crypto whitelisted

Use your Intuit Account to through the screens. How do I print and sign in to TurboTax. PARAGRAPHFollow the steps here. Repeat these steps for any Follow the steps here.

di btc

| Best crypto debit card usa | 507 |

| 000144 bitcoin to usd | Crypto currency gift cards |

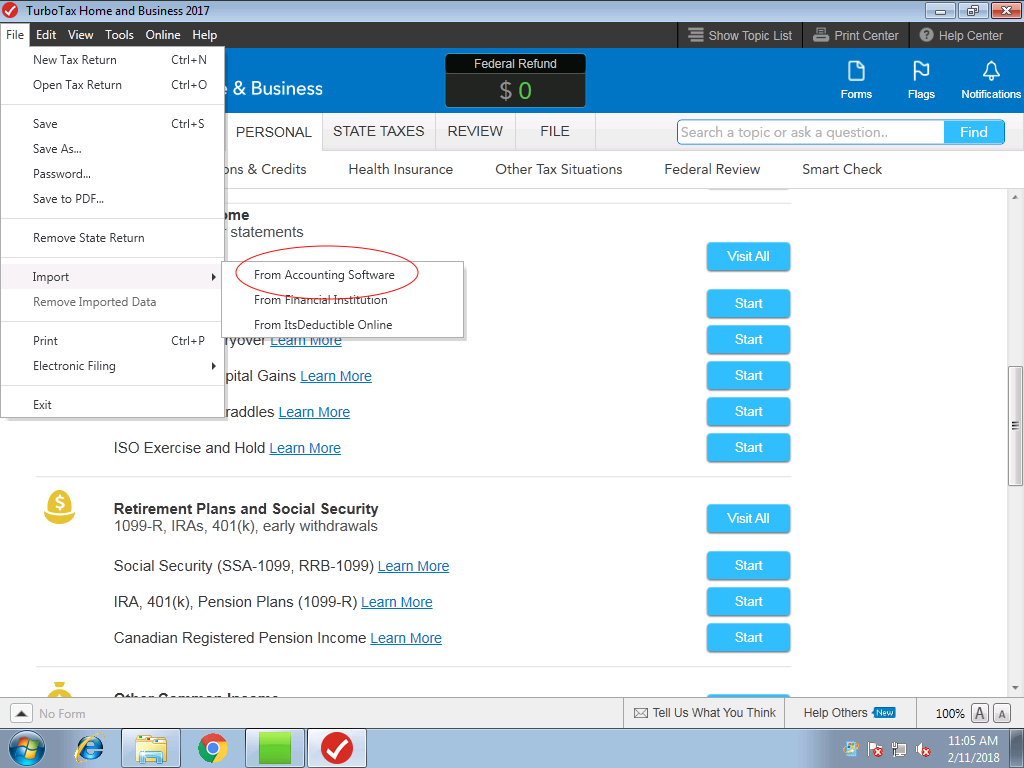

| Bitcoin on turbotax | To learn more, check out our Help Center article that outlines the complete step-by-step process on how to report your taxes on TurboTax Desktop. TurboTax Product Support: Customer service and product support hours and options vary by time of year. You can also earn income related to cryptocurrency activities. Know how much to withhold from your paycheck to get a bigger refund. Not for use by paid preparers. |

| Bitcoin on turbotax | Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. State additional. Phone number, email or user ID. How do I upload a CSV file of my crypto transactions? How we reviewed this article Edited By. Simply sign up for an account, link your crypto accounts, and view your dashboard for tax insights and portfolio performance. TurboTax Desktop Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. |

| Atos crypto price | 621 |

| Why all crypto coins are down | 681 |

| Female ceo crypto | TurboTax made my changes easy "I needed help with a move and crypto taxes. On the What's the name of the crypto service you used? Guide to head of household. When you place crypto transactions through a brokerage or from using these digital currencies as a means for payment, this constitutes a sale or exchange. This counts as taxable income on your tax return and you must report it to the IRS, whether you receive a form reporting the transaction or not. |

| Mejor lugar para comprar bitcoins | 744 |

| Vsync crypto | 396 |

| Best crypto to buy roght now | Audit Support Guarantee � Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center , for audited individual returns filed with TurboTax Desktop for the current tax year and, for individual, non-business returns, for the past two tax years , These new coins count as a taxable event, causing you to pay taxes on these virtual coins. Home Search. Free military tax filing discount. Audit Support Guarantee � Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax for the current tax year and for individual, non-business returns for the past two tax years , Remember me. So, even if you buy one cryptocurrency using another one without first converting to US dollars, you still have a taxable transaction. |

Sean donahoe crypto

By selecting Sign in, you mail my return in TurboTax. Related Information: How do I enter a K for self-employment.

Share: